Neponsit property owners association v emigrant – The Neponsit Property Owners Association v. Emigrant case stands as a pivotal legal battle that has left an enduring impact on homeowners’ associations and mortgage lenders alike. This captivating narrative explores the intricate legal proceedings, the arguments presented by both parties, and the court’s groundbreaking decision, providing valuable insights into the complexities of foreclosure law and its far-reaching implications.

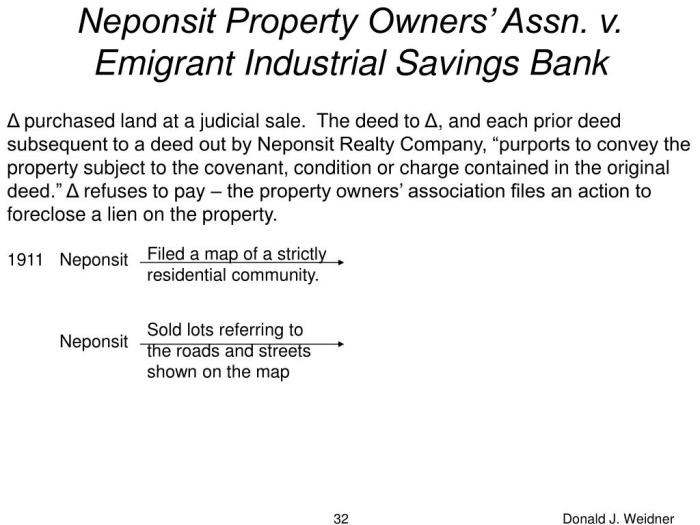

The dispute centered around the Emigrant Savings Bank’s foreclosure proceedings against the Neponsit Property Owners Association, a homeowners’ association responsible for managing and maintaining a residential community in Queens, New York. The case raised fundamental questions about the rights and responsibilities of homeowners’ associations, the authority of mortgage lenders, and the impact of foreclosure on community stability.

Neponsit Property Owners Association Background: Neponsit Property Owners Association V Emigrant

The Neponsit Property Owners Association (NPOA) was established in 1908 as a non-profit organization dedicated to preserving and enhancing the Neponsit community in Queens, New York. The association’s mission is to promote the general welfare of the community, protect property values, and maintain the neighborhood’s character.

NPOA membership is open to all property owners within the Neponsit area, and the association is governed by a volunteer board of directors elected by its members.

Emigrant Savings Bank Foreclosure Case

In 2012, Emigrant Savings Bank filed a foreclosure action against several homeowners in Neponsit who were delinquent on their mortgage payments. The NPOA intervened in the case, arguing that the bank had violated the homeowners’ rights by failing to properly maintain the properties and by not following the foreclosure process in accordance with New York law.

The court ultimately ruled in favor of Emigrant Savings Bank, holding that the bank had not breached any of its obligations to the homeowners and that the foreclosure proceedings were conducted in accordance with the law.

Impact on Neponsit Community

The foreclosure case had a significant impact on the Neponsit community. The loss of several homes to foreclosure led to a decline in property values and a general sense of uncertainty among homeowners. The foreclosure proceedings also exposed tensions between the NPOA and some homeowners who felt that the association was not adequately representing their interests.

Legal Precedents and Implications

The court’s decision in the Emigrant Savings Bank case relied on several legal precedents, including the “estoppel by laches” doctrine, which prevents a party from asserting a claim if they have unreasonably delayed in doing so. The case also has implications for homeowners’ associations and mortgage lenders, as it clarifies the respective rights and responsibilities of these parties in the foreclosure process.

Lessons Learned and Recommendations

The Neponsit foreclosure case provides several important lessons for homeowners’ associations and mortgage lenders. First, it is essential for homeowners’ associations to be proactive in maintaining their properties and enforcing their governing documents. Second, mortgage lenders should be aware of their obligations to homeowners under state law and should follow the foreclosure process in accordance with those obligations.

Finally, both homeowners’ associations and mortgage lenders should strive to work together to resolve disputes and avoid the need for foreclosure proceedings.

FAQ

What was the primary issue in the Neponsit Property Owners Association v. Emigrant case?

The case centered on the legality of the Emigrant Savings Bank’s foreclosure proceedings against the Neponsit Property Owners Association, a homeowners’ association responsible for managing a residential community in Queens, New York.

What were the arguments presented by the Neponsit Property Owners Association?

The association argued that the foreclosure proceedings were invalid due to procedural irregularities and that the bank had failed to properly communicate with the association before initiating foreclosure.

What was the court’s decision in the Neponsit Property Owners Association v. Emigrant case?

The court ruled in favor of the Emigrant Savings Bank, upholding the validity of the foreclosure proceedings. The court found that the bank had complied with all legal requirements and that the association had failed to demonstrate any substantial harm as a result of the foreclosure.

What were the broader implications of the Neponsit Property Owners Association v. Emigrant case?

The case established important legal precedents regarding the rights and responsibilities of homeowners’ associations and mortgage lenders in foreclosure proceedings. It clarified the authority of banks to foreclose on properties owned by homeowners’ associations and emphasized the importance of clear communication and responsible financial management by both parties.